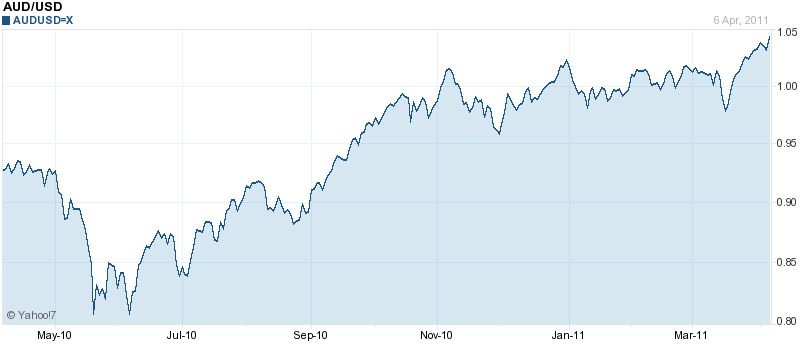

Aussie dollar surges against US, Singapore and HK: time to cash up before you fly?

With the Australian dollar hitting all-time high of US$1.05 against the US dollar overnight, it looks like a great time to stock up on spending money ahead of any forthcoming trips to the US.

We've seen some great above-parity blips this year but this is also the first time that currency exchange shops have nudged the Aussie exchange rate above US$1.

Previous rates have hovered around US95-98c due to the inbuilt retail margin, on top of which most shops charge additional fees or commissions of course.

However, two of our favourite places for travellers to buy foreign currency – the Travelex.com.au website and Flight Centre Travel Money shopfronts – are now listing rates of US1.01.

Flight Centre Travel Money is the best bet if one of their stores is close by, with a rate of US1.019 and free of all fees and commissions if you pay by cash or EFTPOS.

Otherwise, save yourself some time and order online through Travelex.com.au, where you can get the commission-free rate of 1.014 if you pay using BPAY – we explain how this works here.

As usual, avoid the Travelex counters at the airport, which are still offering a mangy US95c – a full 10c short of the real rate – and that's before they take out their commission.

But it's not just the greenback against which the Aussie dollar is sitting pretty.

If your business will soon take to you to Singapore, Hong Kong, Europe or the UK you might also want to splash out and stock up ahead of your 2011 trips.

Singapore dollar: it's been a bit of an unsteady year, as shown above, but the Australian dollar is now a beefy S$1.32, giving super-charged shopping power when it comes to chili crab and the country's overpriced wines (so don't forget to take advantage of Singapore's revised duty-free import rules for alcohol, which doubles the amount of wine you can bring in).

Hong Kong dollar: a similar year to the Singapore dollar, but happily but the Aussie now stands at another record high of HK$8.14.

Japanese Yen: a slow recovery after the initial nosedive in the exchange rate after last month's devastating earthquake and Tsunami sees the Aussie dollar now buying ¥89.28, around ¥8 over this year's average.

Euro: sadly, we're well off the pace compared to the all-time high of around €0.77 (or 77 ‘euro cents’) set earlier this year - but today's €0.73 is the result of a month-long plateau after we climbed out of the last month's €0.70 trough.

UK pound: as with the Euro, we're down from the lofty heights of £0.66 but have climbed back from a sub-61 pence position to £0.64.

If you're wondering about those charts we've used: you can create similar charts to show the history of any currency, over periods ranging from days to years, at the Yahoo!7 finance hub.

Hi Guest, join in the discussion on Aussie dollar surges against US, Singapore and HK: time to cash up before you fly?