The TRS explained: your guide to Australia’s GST refund scheme

The travel rebate program lets you claim back the 10% sales tax on products bought in Australia.

Want to put hundreds of dollars back in to your wallet or purse ahead of your next flight out of Australia? Here’s how to take advantage of the country’s Tourist Refund Scheme or TRS, which lets you claim back the 10% GST sales tax imposed on almost every product sold in Australia.

What is Australia’s Tourist Refund Scheme?

The Tourist Refund Scheme (TRS) allows travellers to claim a 10% rebate on the price paid for almost anything bought in Australia.

That 10% is initially paid up front in the form of the broad-based 10% GST (Goods and Services Tax), but when you leave Australia on a flight or cruise you can get that 10% back in full as an Australian GST refund.

Can Australians claim the TRS rebate?

While the name ‘Tourist Refund Scheme’ implies this program is solely for tourists or visitors to Australia, that’s actually not the case: Australian citizens heading abroad can also claim that 10% GST rebate.

And this doesn’t even need to be on purchases that are leaving the country, such as items bought as gifts.

You can in fact claim the TRS rebate on personal purchases you are taking out of Australia even if you are bringing them back with you.

The only requirement, according to the Government’s Australian Border Force, is that you “declare any goods you bring back to Australia, for which a TRS claim was made by you or another person when the goods left Australia. On returning to Australia, you must declare the goods at Question 3 on your Incoming Passenger Card (IPC).”

Those items are then counted as part of your allowable duty-free concession, with returning Australians each allowed to bring up to $900 worth of goods back into Australia (or $450 per child) without declaring them.

If you’re travelling with others, this allowance can be pooled - for example, a couple travelling with a child is permitted a total duty-free concession of $2,250.

So if you bring goods back into Australia for which a GST refund has been claimed via the TRS scheme, the goods must be declared – and if the value of those goods (combined with any other overseas or duty free purchases) exceeds your passenger concession allowance, any applicable GST and/or duty may need to be paid.

The exception is where another concession is available: for example, the Australian Border Force states “most personal items such as new clothing, footwear, and articles for personal hygiene and grooming (excluding fur and perfume concentrates) may be brought into Australia in your accompanied baggage, free from duty and tax.”

So in short: yes, you can claim that 10% GST off the purchase price of your new smartphone or laptop, noise-cancelling headphones, watch, bag, suit or just about anything else.

How to claim the Australian TRS refund

To start with, there are a few criteria for making sure you can claim the TRS rebate on your purchases.

- eligible purchases must be AUD$300 or more, with each eligible purchase made from a single business with the same Australian business number (ABN). However, your ‘minimum AUD$300 spend’ can cover multiple items and even be spread across several transactions, as long as the total is over AUD$300 and they’re all made from a business with the same ABN

- obviously, you’ll need to hang onto your sales receipt, which should the words ‘tax invoice’ printed or stamped on it

- you must have purchased these goods within 60 days prior to your departure

- you must have paid for the goods yourself

- the items being submitted for a TRS rebate must be for personal use – products bought for business purposes are not eligible for a GST refund

Note that for items costing AUD$1,000 or more, the tax invoice must include a the buyer's identity, such as their full name or passport number.

As this isn’t normal practice for many retailers, you may need to ask the store to prepare a special invoice at the time of purchase.

Most people bring their intended-for-rebate purchases to the airport as carry-on goods, so bear this in mind when it comes to your airfare’s cabin luggage allowance.

Where can I claim the TRS refund?

The TRS refund process takes place at dedicated ‘Tourist Refund' counters are located at each Australian international airport and cruise line terminal.

At airports, these are located after the immigration and security checkpoints – and the TRS offices can get very busy during peak travel times of the day, so plan on making the TRS rebate office your first port of call before heading to the lounge.

In fact, as TRS claims won’t be accepted if your flight is within 30 minutes of departure, you really don’t want to leave this to the last minute.

You’ll need to have with you any goods for which you’re claiming a rebate, along with the original ‘tax invoice’ receipt – before processing your refund, the TRS officer will also need to sight your passport and boarding pass.

There’s also a form to collect at the TRS office and complete before you get to the head of the queue.

Tip: make sure the goods you’re claiming on are easily accessible for presentation at the TRS office, rather than buried deep within your suitcase.

How to speed up your TRS claim

You can spend less time standing in line at the TRS refund office and more time relaxing in the lounge if you fill out your TRS rebate claim in advance.

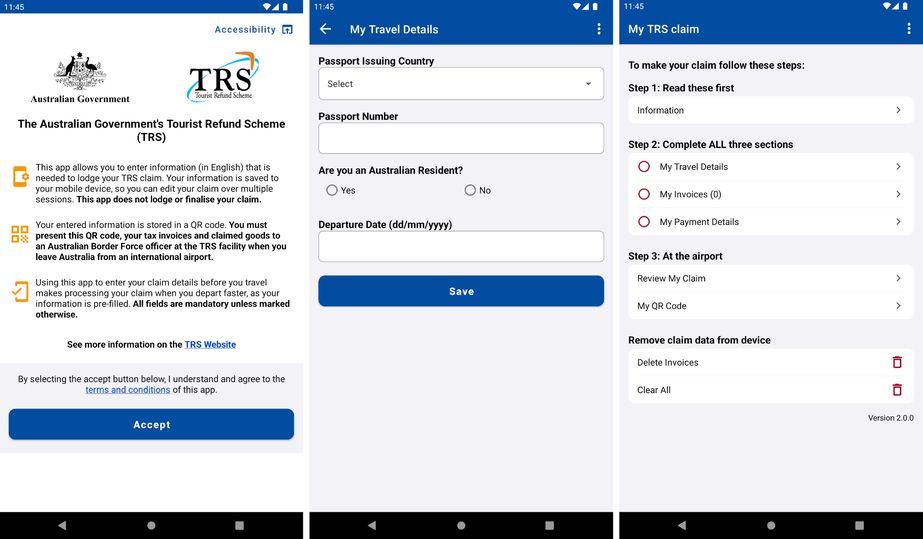

This can be done online at the Web-based My TRS Claim portal or using the TRS App for Apple iOS or Google Android.

You’ll enter the same information as on the paper form and receive a QR code which can be quickly scanned at the TRS refund office to process your rebate; there’s also a separate line at the office for travellers who’ve already used the website our app and have their QR code at the ready.

Can I claim the GST rebate on oversized items?

Although most people present carry-on items at an airport’s TRS refund office, you can also claim the rebate on items that are too large to be considered as hand luggage or are restricted from carry-on.

These can be presented to the Australian Border Force office at the airport or cruise terminal for inspection before you go through immigration and security; if the items are approved for a rebate, your invoice will be stamped to indicate you’re eligible for a GST refund at the main TRS rebate office.

Click through to the Australian Border Force website for a list of its international airport offices.

Calculating your Australian TRS refund

The Australian GST adds a 10% tax on most goods, services and other items sold or consumed in Australia. So how much will your TRS refund be?

You can quickly work out the cost of a product excluding GST by dividing the total price of the product by 11 – this will give you the amount of GST applied to the product, and thus what you’re eligible to claim as your GST rebate.

For example, if you were taking a $1,950 smartphone out of Australia, the GST amount you can claim at the TRS rebate off will be 1950/11 = $177.27.

Of course, the GST is also listed separately on the sales invoice if you’ve got that invoice handy.

How long does the TRS refund take?

TRS rebate payments are typically made to a credit card (such as the card used to purchase the item) or an Australian bank account, and you can expect the refund to be paid within 60 days.

Refunds made by a government cheque posted to your nominated address can take up to two months.

More information on the TRS program can be found on the Australian Border Force website.

Singapore Airlines - The PPS Club

30 Nov 2015

Total posts 10

As someone with a home overseas, it would be great to be able to purchase things for there when coming back to Australia for a visit. But, I concluded that the system, by design, requires so much effort so as to discourage using it.

22 Sep 2020

Total posts 13

It just makes no sense that you have to carry your goods in hand luggage for inspection post immigration. You should be able to take your goods pre-check in for inspection, and then check the goods into your checked luggage. You can do this throughout Europe, the UK, South Africa, etc.

Qantas - Qantas Frequent Flyer

16 Mar 2020

Total posts 25

you can put claimed goods in checked luggage, just need to show ABF office the goods before checking in and ABF stamp the relevant receipts signifying that they have sighted the goods.

Virgin Australia - Velocity Rewards

03 Feb 2018

Total posts 3

The Australian process by design is to make it difficult to reclaim tax under TRS.

The fact that the inspection takes place AFTER security and border control is ridiculous. Other countries have the inspection prior to check-in and is far more convenient for oversized items and just general items that you don't need to carry around with you at the airport and place in those already under-sized cabin storage bins.

And why exactly is the claim process so heavily manual and time consuming?? I could easily design a system to make this pain-free for both travellers and border staff.

06 Jan 2023

Total posts 2

In regards to bringing the goods back into Australia, the article above says this:

"An item’s value is based on the price paid on its receipt"

Any guidance/experience as to whether it would be the ex-GST price or the GST-inclusive price?

Qantas - Qantas Frequent Flyer

04 Feb 2016

Total posts 9

"An item’s value is based on the price paid on its receipt"

Any guidance/experience as to whether it would be the ex-GST price or the GST-inclusive price?

This is one of the 'hidden' costs to the TRS. I understand that If you exceed your duty free allowance upon return the amount payable will be calcuated on the GST inclusive price - if that is what you paid. The outcome is you are then paying GST on your GST.

It is also worth noting that "If you exceed Australia’s duty free limits, duty and tax will apply on all items of that type (general goods, alcohol or tobacco), not just the goods over the limit. (https://www.abf.gov.au/entering-and-leaving-australia/duty-free).

Hi Guest, join in the discussion on The TRS explained: your guide to Australia’s GST refund scheme