Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Notes

The Good

- No international transaction fees

- Uncapped Qantas Points earning

- 50,000 bonus points for eligible new cardholders

The Bad

- Below-parity earning rate on Qantas Points

Added Value

- Fast-track to SPG Gold and Marriott Rewards Gold Elite

Introduction

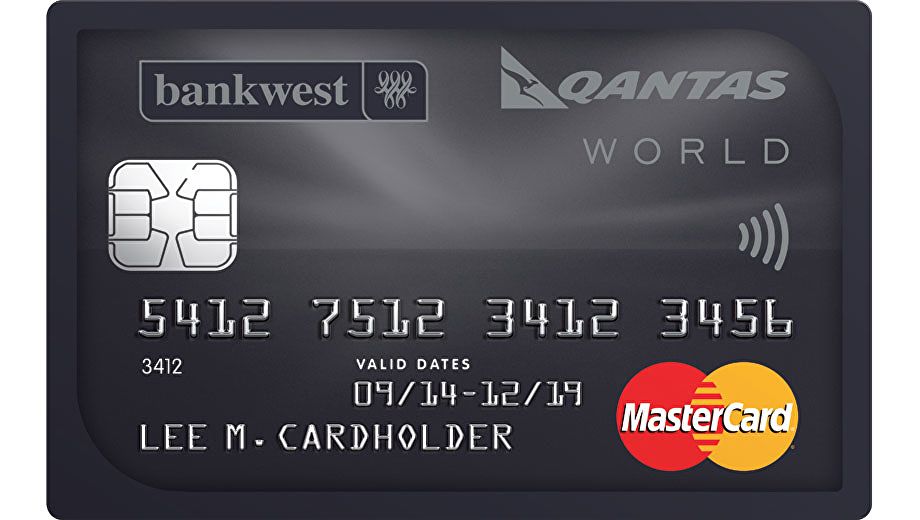

The newly-unveiled Bankwest Qantas World MasterCard is dressed to impress with no international transaction fees, no points capping and a cool bonus of 50,000 Qantas Points for eligible new cardholders.

There's also the promise of Starwood Preferred Guest Gold status after spending just one night at a Starwood hotel in the Asia Pacific region (including in Australia), which you can also match to Gold Elite status in the Marriott Rewards program for perks at a broader range of hotels.

Wherever you're headed, here's what Bankwest's top-of-the-line card has to offer.

Bankwest Qantas World MasterCard: fast facts

- Grade/tier: Black

- Card type: World MasterCard

- Loyalty program: Qantas Frequent Flyer

- Qantas Points earned per $1: 0.66

- Points capping: Uncapped

Fees, charges and interest:

- Annual fee: $270

- Additional/supplementary cardholder fee: $0

- Interest rate on purchases: 20.49% p.a.

- Interest-free days on purchases: Up to 44

- Interest rate on cash advances: 21.99% p.a.

- International transaction fee: None

- Minimum income requirement: None defined

- Minimum credit limit: $12,000

Earning points for free flights:

New Bankwest credit card customers can earn an easy 50,000 bonus Qantas Points when applying by January 16 2017 and spending at least $2,500 on eligible purchases within the first three months.

That's enough to upgrade from business class to first class (pictured) on routes like Sydney or Melbourne to Los Angeles, Dubai or Dallas under Qantas' current rates, or from low-level economy fares to business class on flights from Australia's east coast to Singapore and Hong Kong under new rates which apply from February 2017.

Read: Qantas hikes domestic, international frequent flyer upgrade rates

With no points capping or tiered frequent flyer earning rates, each and every dollar you spend on the card also returns 0.66 Qantas Points wherever MasterCard is accepted, and at no extra cost when travelling abroad courtesy of having no international transaction fees.

Certainly, some cards in the Australian market offer increased earning rates – such as one Qantas Point per dollar up to $2,500 spent per month, reverting to 0.5 Qantas Points per dollar thereafter – although heavy spenders may find themselves earning more points overall every month via Bankwest.

For instance, spending $10,000 per month via Bankwest World nets 6,600 Qantas Points. Spend the same using a tiered-earning card as described above and you'd instead earn a lower 6,250 Qantas Points, being 2,500 Qantas Points from the first $2,500 spent and 3,750 Qantas Points for the remaining $7,500.

Airport lounge access:

Complimentary access to airport lounges isn't a perk offered to Bankwest Qantas World MasterCard customers.

Free international travel insurance:

Spending at least $500 on pre-paid international travel expenses and holding a return ticket before leaving Australia could qualify you for the bank's complimentary international travel insurance on trips of 12 months of less.

That gives you the flexibility to either book your return flights using your Bankwest card, or to use Qantas Points to book your airfares and your Bankwest card to pre-pay other costs like hotel stays or hire cars before your journey begins.

Bankwest also includes interstate flight inconvenience insurance, purchase security cover, appliance extended warranty cover and a purchase price guarantee, although car hire insurance excess is limited to international trips rather than being offered within Australia, as found on some other Black-tier cards.

Bankwest Qantas World MasterCard: the verdict

At $270/year, cardholders will want to make sure they're getting value for money by taking advantage of the Qantas World MasterCard's many features, rather than relying on frequent flyer points alone.

For instance, in the first year the value you can derive from 50,000 bonus Qantas Points more than offsets the annual fee, while in future years, the savings had by not needing to purchase standalone travel insurance or appliance extended warranty covers could also get you over the line.

There's also a fast-track to Starwood Preferred Guest (SPG) Gold to consider, with benefits such as room upgrades, welcome amenities, late check-outs and extra points with every stay at hotels like Westin, St. Regis, W Hotels and The Luxury Collection.

The recent merger between Starwood and Marriott provides a further free match for SPG Gold members to Gold status in the separate Marriott Rewards program, offering other benefits like complimentary breakfast and hotel lounge access at Marriott hotels, plus room upgrades with The Ritz-Carlton, among other brands.

But back on the ground, there's no harm in pairing your Bankwest card with something like the Qantas American Express Discovery Card to use wherever AMEX is accepted, serving up a higher one Qantas Point per dollar spent, uncapped, and with no annual fee.

Also read: Bankwest Qantas Platinum MasterCard review

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Qantas - Qantas Frequent Flyer

25 Jan 2013

Total posts 240

Do you know if there are any simple good articles that describe the credit card rankings. That is, Visa Gold/Platinum/Signature/Infinite vs. Mastercard Gold/World/World Elite etc. and their differences or benefits?

24 Apr 2012

Total posts 2424

Hi Jono, it's not something we've covered because cardholder benefits are at the discretion of each card issuer, with a few exceptions like the SPG Gold fast-track for MasterCard World & World Elite cardholders living in APAC.

In our books, the blanket level above 'Platinum' these days is 'Black' which includes anything that's higher than Platinum.

Above 'Black', all that's left is 'Invitation Only', such as the American Express Centurion Card.

Qantas - Qantas Frequent Flyer

25 Jan 2013

Total posts 240

Fair point Chris. So there is never any need for a 'Visa Infinite = Mastercard World Elite' or "Visa Platinum = Mastercard World' article cause it's all just a slight more shnazzy looking card. Cheers.

Qantas - Qantas Frequent Flyer

19 Nov 2011

Total posts 243

I've cancelled this card and replacing with Coles Mastercard with Flybuys earn. Earn rate, annual fee ($89 p.a.), flybuys points flexibility, no foreign transaction fee beats this card.

Qantas - Qantas Frequent Flyer

17 Oct 2016

Total posts 11

I applied for this card online today, my income is over $1M PA, $10M of assets, they told me I could have a 5K credit limit and no Qantas world card. go algorythms!

Sorry Bankwest but I don"t think I will be doing business with you anytime soon.

Hi Guest, join in the discussion on Bankwest Qantas World MasterCard