Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

With an impressive roster of airline partners including Virgin Australia, Emirates, Singapore Airlines and Cathay Pacific, the American Express Membership Rewards program gives you the flexibility to spend when it’s convenient to you, while deciding what to do with your points at a later date.

That’s great if you’re planning a trip but haven’t yet decided where, or when your ability to use frequent flyer points on your preferred travel dates varies from airline to airline, as you can store them in your MR account until it comes time to book that journey.

Here’s what you need to know about AMEX Membership Rewards, and what to look out for if your wallet packs one of the David Jones American Express cards.

American Express Membership Rewards 101

Membership Rewards (MR) is the default points currency on most cards that are directly issued by American Express – note that this excludes American Express cards from other banks such as ANZ, CBA, NAB and Westpac.

Among those that earn MR points: the Platinum Edge, Platinum Charge, Business Accelerator and the invitation-only American Express Centurion charge card.

Also on the list but segregated from the rest: the David Jones American Express cards, earning their own form of ‘David Jones Membership Rewards’ points but which are half as valuable as ‘Membership Rewards’ points – more on that later.

Other cards issued directly by AMEX such as the Qantas Ultimate card and the free Velocity Escape card aren’t part of the Membership Rewards scheme, instead automatically depositing points into your frequent flyer account each month.

The number of MR points you’ll earn varies from card to card and sometimes from transaction to transaction, with some cards offering a flat earning rate on all of your spend and others serving up more points in categories like dining, fuel and supermarket purchases but fewer points on utility, insurance and government payments.

Membership Rewards: earning frequent flyer points

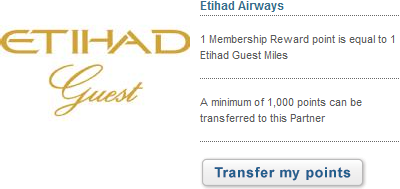

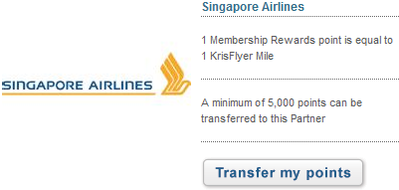

After earning American Express Membership Rewards points, cardholders can then convert those into frequent flyer points with the likes of Virgin Australia, Air New Zealand, Cathay Pacific, Emirates, Etihad, Malaysia Airlines, Singapore Airlines, Thai Airways and Virgin Atlantic.

In most cases the conversion rate follows an easy-to-understand 1:1 ratio, so one AMEX MR point is generally equal to one frequent flyer point or mile, with the exception of Emirates and Air NZ where one MR point buys 0.75 Skywards miles or $0.01 in Airpoints value.

An exception to the exception: Centurion and Platinum charge card holders can ship their MR points to Skywards on a 1:1 basis, and also to Qantas Frequent Flyer at the same rate.

These are the only two personal cards that allow the conversion of Membership Rewards points into Qantas Points, so if that’s your goal, avoid the other MR cards or opt for something from the Qantas American Express Discovery, Premium and Ultimate range of cards.

Membership Rewards members can also convert their MR points into Hilton HHonors points on a 1:1 basis or can net one Starwood Preferred Guest Starpoint for every two MR points.

A note of difference: David Jones ‘Rewards Points’

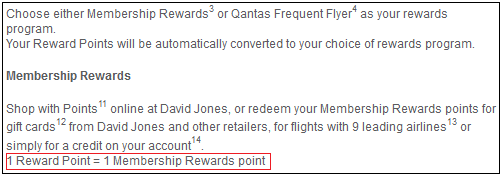

Contrary to AMEX’s general Membership Rewards card range and its 1:1 conversion to most frequent flyer programs, the David Jones and David Jones Platinum American Express cards are a different beast.

On both cards members can choose to earn a direct 0.75 Qantas Points per dollar spent on everyday purchases, or can instead pocket ‘Rewards Points’, which the American Express website shows are of equal value to Membership Rewards points:

However, the David Jones cards don't earn traditional Membership Rewards points – rather, 'David Jones Membership Rewards’ points which aren’t as valuable.

For example, one DJMR point lands you just half a point or mile with Virgin Australia, Cathay Pacific, Emirates, Etihad, Malaysia Airlines, Singapore Airlines, Thai Airways and Virgin Atlantic, whereas a regular MR point would otherwise return one whole point, or a still-higher 0.75 miles with Emirates on most cards.

Also reduced is the conversion rate with Air New Zealand and Hilton HHonors – one DJMR point buys just $0.005 in Airpoints dollars or half a Hilton HHonors point, rather than the standard rate of one whole Airpoints cent or HHonors point.

In short: You'll earn the most frequent flyer points by sticking to the ‘pure breed’ of Membership Rewards cards unless the other benefits of the David Jones cards are of use, such as free gift wrapping, product home delivery and increased earning rates on David Jones spend.

Converting MR points to frequent flyer points

Swapping your Membership Rewards points for frequent flyer points or miles is easy: just head to the American Express website, choose your preferred airline (or hotel) partner and click ‘transfer my points’:

Different minimum transfer amounts apply to different airlines – you’ll notice a 1,000-point minimum above with Etihad Guest, while other airlines such as Cathay Pacific, Singapore Airlines and Thai Airways require at least 5,000 MR points in your account before a transfer can be processed:

Again, to earn Qantas Points, you’ll need either a Platinum or Centurion charge card (this excludes Platinum-grade credit cards such as the American Express Platinum Edge), or one of the direct-earn Qantas cards such as Qantas Discovery, Premium or Ultimate.

More on earning credit card frequent flyer points:

- The ANZ Rewards credit card program: what you need to know

- Getting the most from the Commonwealth Awards credit card program

- Five credit card strategies to maximise your frequent flyer points

- The best of black: the top frequent flyer credit cards

- Westpac Altitude Rewards: our '101 guide'

Follow Australian Business Traveller on Twitter: we're @AusBT

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Qantas - Qantas Frequent Flyer

25 Jan 2013

Total posts 240

American Express has always lost favour with me on account of the reduced earn rate on the David Jones cards. I get in the small print it does specify the difference between ‘David Jones Membership Rewards’ and ‘Membership Rewards’. However, I wonder how many people have signed up expecting a 30,000 point bonus and then gotten shocked to find it’s actually 15,000.

It seems kind of disrespectful to hide this in the small print. However, I suppose credit cards is one of the few things where most people would read the fine print.

Virgin Australia - Velocity Rewards

28 Apr 2014

Total posts 30

Can't say enough about the AMEX Platinum Edge, quite often free for the first year ($200 otherwise), which earns 3 MR points per $ at supermarkets!

And on top of that you get a free economy-class return flight on Virgin Australia; especially massive value for people like me out of Perth for transcontinental returns..!

Nothing wrong with buying Officeworks or JB Hifi giftcards at Coles or Woolies and using them for your next laptop purchase, and scoring 3 points per $ for that laptop (or whatever you decide to buy)..!

16 Jun 2015

Total posts 1

You completely forgot to mention the DJ Amex bonus earn ratio which infact makes it one of the most competitive credit cards in the market.

DJ AMEX: ($99.00 - First Year Free after 3 spends outside of David Jones)

3 pts per $ at Supermarkets and Petrol Stations = (3 x 0.75) 2.25qf per dollar spent

2 pts per $ at David Jones = (2 x 0.75) 1.5qf per dollar spent

1pt everywhere(EVERYWHERE) else = (1 x 0.75) .075qf per dollar spend (as opposed to centurion and platinum who spend with govt, insurance or telecommunications and earn 0.5qf pr $ spent)

DJ Platinum; ($295.00 - Includes complimentry travel insurance and ext warranty)

4pts per $ at David Jones = (4 x 0.75) 3 qf per dollar spent

3 pts per $ at Supermarkets and Petrol Stations = (3 x 0.75) 2.25qf per dollar spent

1pt everywhere(EVERYWHERE) else = (1 x 0.75) .075qf per dollar spend (as opposed to centurion and platinum who spend with govt, insurance or telecommunications and earn 0.5qf pr $ spent)

Compare this with the visa/amex combo offered by ANZ for $90.00 a year which gives 0.5 qf per $ for anz visa and 1 qf per $ for anz amex and i can see which one is better, at least for everyday spends such as groceries (Coles, Woolworths, IGA,Franklins,Supabarn, Thomas Dux and Harris Farm) and Petrol (BP, 7/11, Coles Shell and Woolworths Caltex).

24 Apr 2012

Total posts 2424

Hi djalliance,

We didn't 'forget' to include this – this is a beginner's guide to the Membership Rewards program and what to do with your points once they've been earned, as opposed to an article that highlights the credit cards that earn the most frequent flyer points.

That being the case, we included one paragraph explaining that the number of MR points earned per dollar spent can vary:

--

The number of MR points you’ll earn varies from card to card and sometimes from transaction to transaction, with some cards offering a flat earning rate on all of your spend and others serving up more points in categories like dining, fuel and supermarket purchases but fewer points on utility, insurance and government payments.

--

It also wasn't a comparison article comparing the products of different banks, which is a topic we frequently cover in dedicated editorial.

Cheers,

-Chris

Hi Guest, join in the discussion on American Express Membership Rewards explained