Citibank backs down on changes to credit card frequent flyer rates

UPDATE | Citibank has abandoned controversial changes to the frequent flyer 'conversion rates' under the Citibank Rewards program.

A Citibank spokesperson has confirmed to Australian Business Traveller that the revised rates at which Citi Rewards Points could be swapped for Virgin Australia and Singapore Airlines points as of November 1st – a move the bank took without prior notice to customers – would now be wound back.

Those changes resulted in an immediate effective 'devaluation' of Citi Rewards Points as high as 25% and was also to be applied to customers' existing Citibank points balances as well as future transactions.

Citibank cardholders will once again be able to swap the bank's own points for airline frequent flyer miles at the previous, more generous rates.

The Citibank spokesperson said "we expect the changes to be made as soon as possible, but (it) will likely be a couple of days (before these take effect)."

Card Services customers – a division of Citigroup that includes Suncorp Bank Rewards, CUA and QT Mutual – will too have their conversion rates restored from 2.5 Suncorp/Card Services points = one frequent flyer point to the preferred 2=1 rate following similar cuts, the spokesperson confirmed.

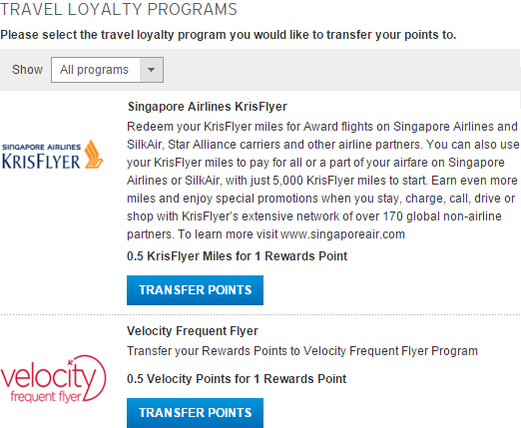

PREVIOUS | Citibank credit card customers will earn fewer frequent flyer points on their everyday transactions, due to changes to the bank's 'exchange rate' for converting Citi Rewards Points to Virgin Australia Velocity points or Singapore Airlines KrisFlyer miles.

Effective immediately, you’ll need two Citi Rewards Points for every Velocity Point or KrisFlyer mile earned via the Citibank Signature, Prestige and CitiBusiness Gold credit cards, compared to the previous rate of 1.5 Citi Rewards points.

For Citibank’s Gold and Platinum customers, one Velocity Point or KrisFlyer mile will now require 2.5 Citi Rewards points, up from 2.0 points previously.

Existing Citi Rewards balances also hit

The unexpected and unannounced devaluation of Citi Rewards points also applies to your existing Citibank points balance, rather than future transactions – a move which has in effect reduced the value of Citibank Rewards Points by 20-25% overnight.

Controversially, Citibank credit card customers received no prior notice of the new conversion rates until they took effect from November 1.

This is at odds with a '90 day' notice clause in the Citibank Rewards Terms & Conditions, concerning changes to the way in which points are earned or converted.

In response to questions posed by Australian Business Traveller, a Citibank spokesperson said "The 90 days’ notice is based on if we remove the program in whole or change the way points are earned in the rewards program, or in the case of Citi Prestige Qantas and Signature Qantas, the way points are converted ie $1 spend = 1 QFF Point."

"Under this same general clause (Section 6), (when) the cost of individual rewards available in the program for redemption (varies)... we will notify you on the website at the time of your redemption – consistent with the below highlighted terms:"

However, the bank did not reply to additional questions asked by Australian Business Traveller – including whether Citibank partners Virgin Australia and Singapore Airlines have increased the cost of purchasing each frequent flyer point, and why the bank elected to provide no notice even if permitted by its own T&Cs.

Citibank: what you’ll now earn per dollar spent

As most Citi customers first accrue Citibank Rewards Points (or CitiBusiness Rewards Points) and later convert these into frequent flyer points with the airline of their choosing, here’s how the new conversion rates change what you’ll effectively earn with Velocity or KrisFlyer on every dollar spent:

- Citi Prestige: $1 spent in Australia = 1 VA/KF point, down from 1.33. A$1 spent abroad = 2.5 VA/KF points, cut from 3.33.

- Citibank Signature: $1 spent on home soil = 0.75 VA/KF points, reduced from 1. A$1 spent overseas = 2 VA/KF points, dropped from 2.66.

- Citi Platinum: $1 spent locally = 0.5 VA/KF points, down from 0.625. A$1 charged at foreign merchants = 1.2 VA/KF points, lowered from 1.5.

- CitiBusiness Gold: $1 spent = 0.625 VA/KF points at any merchant, a decrease from 0.83.

- Citibank Gold: $1 spent = 0.4 VA/KF points on all transactions, down from 0.5 previously.

Although no longer available to new customers, Citibank Gold now ties with the Commonwealth Bank’s Awards and Gold Awards MasterCards as offering the lowest number of airline frequent flyer points per dollar spent of any points-earning credit card in the Australian market.

Citibank credit cards that automatically sweep each month’s frequent flyer earnings across to your airline account – such as the Emirates Citibank World MasterCard – aren’t affected by these changes, nor are members of the Citibank Qantas Rewards program who retain the same earning rates.

The conversion rate from Citibank Rewards Points to Emirates Skywards miles is also unaffected, while it's believed that conversion rates with Citi Prestige's longer raft of airline partners including Air France, Cathay Pacific and Etihad too remain unchanged.

Also read: ANZ boosts Virgin Australia Velocity credit card points

Follow Australian Business Traveller on Twitter: we're @AusBT

20 Apr 2014

Total posts 93

NAB tried a similar devalution of points which the ACCC put a stop to in 2002.

Anyone affected may wish to lodge a consumer complaint with them over Citi restrospectively devaluing their points.

https://www.accc.gov.au/media-release/accc-ends-investigation-of-proposed-retrospective-point-value-changes-to-the-nab

16 Mar 2014

Total posts 20

Hope this doesnt happen to their cards linking points to QF!

04 May 2015

Total posts 261

By their own admission above, they'd have to provide 90 days notice for that:

"The 90 days’ notice is based on if we remove the program in whole or change the way points are earned in the rewards program, or in the case of Citi Prestige Qantas and Signature Qantas, the way points are converted ie $1 spend = 1 QFF Point."

20 Feb 2014

Total posts 7

Not sure if you all notice....Qantas has recently devalued the QFF point. Back in late August 2015, you only needed 74,700 points for a $500 Woolworths giftcard. I looked at the rate again on Monday 2 November 2015, now you need 87,650 QFF points...Yes, you lose 17% in value of QFF...a lot more than the inflation rate. They did not inform us of the devaluation at all. I wrote emails to them and did not get any replies. Anyway, the next thing you know is that QFF is becoming worthless as days go by.

28 Oct 2011

Total posts 645

'effective immediately'...geee, some financial institutions in this country really treat their customers like 's**t'...and sadly will continue to do so...because they can...thankfully I have NO TIES with any such institutions, and I hope others take the time to 'shop around'. Often, bigger isn't always better ;)

04 May 2015

Total posts 261

So basically, Citibank is happy to fundamentally change its products and the value of points that have already been earned without so much as a moment's notice?

Citi is clearly defending what it believes to be an 'out' buried within its T&Cs. What's to say that after a month or year passes, this mob won't 'immediately' cut the conversion rates again, screwing over its customers a second time around?

I'll be complaining to Citi and demaning the points back that they've basically stolen from me by a few clicks of the keyboard, and to the ACCC and the FOS if necessary.

Oh, and I'll be cancelling all of my Citi cards once that's sorted – the bank clearly can't be trusted to act in consumers' interests and obviously doesn't mind pulling the carpet out from underneath its customer base.

QF Platinum

24 Jan 2013

Total posts 138

I called and complained about it, and they fell back on their T&Cs. I doubt they'll reinstate the points we all rightfully deserve. Instead I took as much compensation I could get. I got offered 5000 pts initially, then $350 fee refund, then $350 + 2500 pts, then settled at 10000 pts. I heard others getting similar compensation. Better than nothing but still lost out over this fiasco...

Qantas - Qantas Frequent Flyer

06 Nov 2014

Total posts 358

Hey propofol: I assume you are a fellow anaesthetist with your name? Anyway, someone in AFF has offered to write an official letter and needs more people to join and show how disgusted we are. Last year QLD health tried to screw us up and it was the doctors all got together that forced them to come back to the negotiation table. So if we get together, we can make Citi willing to talk.

QF Platinum

24 Jan 2013

Total posts 138

Yes, I am an anaesthetist practising in SA :) Please include me in the letter. It's absolutely disgusting the disdain Citibank has shown its premium customers...

Qantas - Qantas Frequent Flyer

22 Apr 2014

Total posts 10

count me in on the letter as well, i have 200k points with citi prestige and am really annoyed that i received no notification about this

Singapore Airlines - KrisFlyer

06 Feb 2014

Total posts 69

Propofol88, how did you pull off that 10000 pts compensation? When I called to complain, they couldn't care less and declined any kind of compensation. In Australia we have no choice , the banks are too arrogant , they don't care for customers evn at the high end. I will use the citi prestige card as little as possible now and I encourage everyone else to do the same . What else can we do?

QF Platinum

24 Jan 2013

Total posts 138

I sounded like a valued customer who they really ticked off and waned the blood of the floor supervisor's first born... Dunno. Haha. :p

04 Nov 2015

Total posts 4

I called and got put on to the 'floor supervisor'. She offered me 10,000 points which I took seeing as I wasn't affected as much as others and only had 45,000 points anyway!

QF Platinum

24 Jan 2013

Total posts 138

We both have been relatively lucky. I had 90k points. I know someone who was gutted having hundreds of thousands of points with Citibank. Evil bank scammed away several tens of thousands of dollars worth in points!

Qantas - Qantas Frequent Flyer

22 Apr 2014

Total posts 10

i have 200k......i guess it's time to look for another card

07 Mar 2013

Total posts 31

Citibank has just started to reply to Facebook posts that points conversion rate will be returned to 31 Oct levels!

Qantas - Qantas Frequent Flyer

06 Nov 2014

Total posts 358

According to Krisflyer T&C clause B 1&2, G.7: "Miles are the base units of measurement in the Krisflyer Programme....Miles may not be exchanged for cash or vouchers". "The sale or barter of Krisflyer miles.....is prohibited..."

According to Velocity's T&C clause 9.1.b,c&d: "Points..are solely a unit of measurement adopted by VRPL and NOT any form of contractual right, PROERTY or currency...are not subject to member's direction, control or other entitlement... cannot be purchased"

Both specifically said its only a unit of measurement, not goods or service, and are not owned by the member. Citibank is referring to KF and VA points as a goods to be redeemed by us. They themselves have violated the terms and conditions of KF and VA.

04 May 2015

Total posts 261

WOW! Amazing to see what media exposure and pressure from customers can do.

The issue for me wasn't so much that the conversion rate changed – these things happen all the time – it's that Citibank never told anybody it was happening, so overnight, practically every cardholder lost a decent chunk of value from their points balance.

Being realistic, I'm sure Citi will eventually reduce its Velocity/KrisFlyer conversion rates to what we saw on November 1, but after this incident they would be silly to try doing so again without providing any notice.

Qantas - Qantas Frequent Flyer

06 Nov 2014

Total posts 358

They are not that silly. They will do it again, except this time they are covered. Please read my post below.

02 Dec 2011

Total posts 47

Well done everyone who called/emailed/posted on social media to Citibank. People power can work.

I rang them yesterday to lodge a complaint, got a case ID, mentioned that the ACCC has previous form, put on the hard hat for the long fight...rather surprised to get the phone call reversing their decision.

Citi has come through this with less friends for zero gain. Zeroing my rewards balance after this weekend.

Qantas - Qantas Frequent Flyer

06 Nov 2014

Total posts 358

Guys, don't relax yet. the war ain't over yet. Citibank have just added new terms and condition. Go to your reward page and click on terms and condition. There is a new clause 3.6 specifically at POINT TRANSFER (this time, the wording is very specific), and I want you to pay attention to clause 3.6.4 which states:

"We may change the POINT TRANSFER program rule......in whole or in part AT ANY TIME with or without notice."

So if they decide to devalue again after 10 minutes of reverting to the old rate, they can do so according to this new T&C.

Beware!

Qantas - Qantas Frequent Flyer

19 Nov 2011

Total posts 243

Are they looking to lose customes? How hard is it to just have notification to the customers? With this attitude, they leave themselves as an entity that is less to be desired to do business with.

When ANZ and CBA changed their points conversion from their respective reward programs to frequent flyer programs, they were kind enough to let everyone know ahead and when it will take place. So, customers could do something about it whether is redeemed them or let it sit there.

Qantas - Qantas Frequent Flyer

06 Nov 2014

Total posts 358

Some fellow frequent flyer member with law background has adviced that Citibank can't unilaterally alter the contract. The terms and condition we agreed to when we signed the card was the old one. Please keep a copy of the old T&C and if they devalue again without notice, the new T&C has no legal value as it was tempered by them unilaterally without our consent.

11 Apr 2014

Total posts 13

Thanks very much for highlighting that change to the T&Cs.

Card cancelled.

Emirates Airlines - Skywards

07 Sep 2012

Total posts 146

When Citi cut the earn rate of their Emirates Platinum Cards from 1.5 points per dollar to 1 point in the first half of 2014, they gave us quite a few months notice, so I'm surprised that they tried to pull this new stunt on this occasion, although they also replaced the actual card with a new one called the Emirates Citi World card and this card costs merchants way more in commission charges than the old one did.

If the day ever comes that merchants are informed by their terminal at the time of transaction just what level of commision they're being charged, these cards are going to become worth a lot less to users like us.

07 Nov 2015

Total posts 2

This is unbelieveable! I have almost 200.000 citibank points and was about to use for a business ticket with Singapore Airlines. I'll call Citibank and cancel my card.

Singapore Airlines - KrisFlyer

06 Feb 2014

Total posts 69

Marcoaaj

They have just reversed that change, so your Miles are safe for now, just go ahead and transfer them to Singapore Airlines ASAP before these guys change the transfer rate again, and don't cancel the card just yet.

07 Nov 2015

Total posts 2

Yes, I was so pissed off that I didn't read it properly :-)

I checked yesterday night and the points were still reduced. Today Citi's website is under maintenance so tomorrow I'll check and claim my points if they are back to normal.

Such a bad luck, I was booking my ticket with Singapore airlines!

Singapore Airlines - KrisFlyer

06 Feb 2014

Total posts 69

Marco

I called them and they said that they will adjust the missing Miles in the next few days , they will not appear in the krissflyer acct immediately, they will have a large backlog to clear

Qantas - Qantas Frequent Flyer

06 Nov 2014

Total posts 358

Just before everybody get too excited and start to convert all points to KF, please consider:

1. Can you use up all the points in the next 3 years? KF points expires in 3 years. So if you have millions of points, it's probably best to put some into VA

2. Before you transfer your points, you have to tick on the "I agree to the T&C" button. If you click on the T&C that's highlighted in blue, you will see the new clause 3.6, which you agree that Citi can change the rules in the future AT ANYTIME with or WITHOUT notice. This is legally where is gets tricky. Yes, legally they can't unilaterally change the contract without your consent. But as soon as you click on the "I agree" button you have given consent to the new T&C. So if this ever happen again, you are not protected!

Some of our legal friends have raised this concern in writing to Citibank and is awaiting for an answer. I wonder if Chris or David is reading this, if you can contact Citibank and see what they say. I contacted Citi over the phone, got the standard answer saying "we value our customers that's why we listened and reversed the transfer rate and we will notify you next time for any change in the future". How much do you believe in that is up to you But I'll feel more comfortable if Citibank can make a public announcement.

Singapore Airlines - KrisFlyer

06 Feb 2014

Total posts 69

Michael, you are right , but at some point citibank can rewrite the whole thing and give you 90 days notice so then if decide to transfer the points , you would have to consent to new the terms and conditions anyway , even if you are transferring to Velocity. Also I find that you need a lot more velocity points to get the same SQ flights . I suppose if you have Millions of Citibank reward points it's not a bad dilemma! It was because of the 3 yr expiration of Krissflyer Miles that I was hanging on to my citi reward points anyway!

Qantas - Qantas Frequent Flyer

06 Nov 2014

Total posts 358

The devaluation will definitely come. It's to do with the reduced visa interchange rate so Citi isn't the only one reducing the point earn. HSBC and EDR have put a cap on their point earn as well. But HSBC had given it's customer plenty of warning, and were willing to compensate for customers. In my case, I got it annual fee free.

The problem with Citi is not the devaluation but the lack of warning. So I agree that T&C will change and customers may need to agree with the new T&C if willing to continue with Citi card. But I believe the customers should be given the warning and the option of whether to continue using it or not. IMO, Citiprestige is still good value given the perks that come with it. But for signature, at 0.75/$, an annual fee of $300 is a bit rich. I would look for something else on the market.

ANZ

17 Feb 2016

Total posts 2

We have recently received notification of a reduction in our ANZ rewaards point. This change takes effect on the 17th March 2016. However ANZ are still advertising their "old" rates and points on their website and in their branches. It is quite a significant decrease in benefits eg ANZ Rewards are halved from 1.5 points to .75 points using visa.

Does anyone know if other banks are reducing their points?

What are the best value reward plans?

Emirates Airlines - Skywards

07 Sep 2012

Total posts 146

Almost every bank has either done this, or is about to do this James. It's a direct response to the Reserve Banks edict that Banks must reduce the commission they charge merchants on these cards to no more than about 0.8%. Currently, they're charging up to around 2% for the premium cards, which is what was funding the airline points you were earning.

ANZ

17 Feb 2016

Total posts 2

Many thanks Brian. At least the merchants are the winners so that is a good thing

Hi Guest, join in the discussion on Citibank backs down on changes to credit card frequent flyer rates