Travellers are increasingly warming to prepaid travel money cards as the next best thing to carrying cash.

Travel money cards such as the well-known Travelex Cash Passport and the relatively new American Express Global Travel Card combine the convenience of credit cards with the simplicity of cash exchange.

When you buy a travel money card you also buy a certain amount of foreign currency at that day's exchange rate. This sits in credit on the card in the foreign currency -- unlike the fluctuating exchange rate that applies to credit cards and ATM withdrawals when used overseas.

Travel Money cards also have the advantage of being totally separate from your bank account. Even if your card is defrauded while overseas, the most you could lose is the amount of money you've preloaded onto the card.

The biggest advantage of all, though, is that there are no per-transaction fees for using travel money cards to make purchases.

Unlike credit cards that charge up to 3.5% on every overseas purchase ($35 out of every $1,000), if you've loaded a travel money card with US dollars, and make a purchase in US dollars, there's no surcharge. In that way, they're much like spending cash.

ATM cash withdrawal fees are also cheaper with travel money cards than with ordinary bank ATM cards. For example, NAB charges $4 + 2% per overseas withdrawal ($24 on $1000), while ANZ, Commonwealth Bank and Westpac charge $5 + 3% ($35 on $1000).

However, travel money cards charge no percentage surcharge (as long as you're withdrawing cash in the currency you loaded onto the card) and a reduced flat fee -- for example, $2 for US dollar withdrawals on an American Express Global Travel card.

The four cards on test

We compared the four cards on the market:

- ANZ Travel Card

- Commonwealth Bank Travel Money Card

- American Express Global Travel Card

- Travelex Cash Passport

Many outlets offer travel money cards that are just rebranded Travelex Cash Passport cards. We have not included them in this review.

Revealed: the hidden fees of travel money cards

Like any financial product, all sorts of fees and charges apply to catch the unwary. Still, even cash exchange is laden with fees, as evidenced by the atrocious rates charged at bureaux de change for walk-in (not pre-arranged) exchanges.

We've done the work of sifting through the fees and charges for you, to identify the charges you need to watch out for.

Initial card purchase fee: with all the travel money cards, you pay a one-off fee to buy the cards. This ranges from $11 (ANZ Travel Card) to $15 (all the others). Compared to the rest of the fees, this fee is inconsequential, however if you are travelling to numerous countries with different currencies, it does become more important if you have to buy travel money cards in various currencies, where the up-front fee is multiplied by the number of cards you need.

It is worth noting that the American Express and Travelex cards can be purchased at Australia Post with an $0 card fee, rather than the standard $15 card fee.

Initial cash purchase surcharge: most cards include the initial 'cash load' onto the card as part of the purchase fee. The only exception is Travelex, and only if you are loading Australian dollars onto the card -- they will take 1.1%. Loading a foreign currency onto a Travelex card is free when you initially buy the card.

Cash reload fee: when you need to add more money to the card, all the cards charge 1 to 1.1% of the amount you're loading on. American Express Global Travel Card compares well to the other cards here -- it charges 1% of the reload amount, but caps it to a maximum of $10 each time, which means any recharge over $1,000 is a discounted rate.

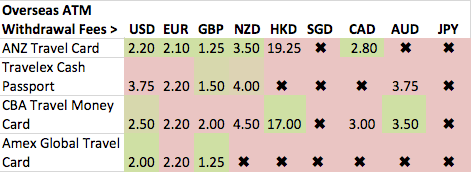

ATM withdrawal fees: every time you withdraw money from a foreign ATM, there's a flat fee charged. The cheapest fees are from American Express and ANZ -- $2.00 and $2.20 respectively for a withdrawal in the USA or £1.25 in the UK. Travelex is more expensive, charging $3.75 for a withdrawal at a USA ATM, and Commonwealth Bank is between the two extremes.

Shop surcharges: while this is not strictly a fee directly charged by the travel card provider, it will affect you nonetheless. While Visa and Mastercard purchases don't usually attract additional surcharges when paying for something at a shop, American Express cards often do. Using the American Express Global Travel card means you'll be paying up to an additional 5% on purchases (the average seems to be around 2.5 - 3%, and some outlets charge nothing extra and absorb the Amex cost into their prices.) In the USA, merchants are contractually obliged to American Express not to charge surcharges for American Express purchases, but some will still try to apply them.

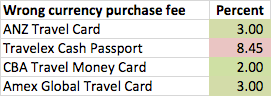

Wrong currency purchase fee: if you've loaded US dollars onto your travel money card but buy something in British pounds, the travel card provider charges a percentage surcharge to convert the transaction across. This is generally a similar rate as what's charged for ordinary overseas credit card purchases -- ANZ just says "the wholesale market rate from Visa", while Commonwealth Bank charges 2%, and American Express 3%. Travelex is horrendous on this point: it slugs you 8.45% of the transaction.

ANZ figure is estimated

Monthly inactivity fee: ANZ and Travelex start draining your card balance if you haven't used the card for more than 12 months, at the rate of a few dollars a month. Commonwealth Bank and American Express do not charge this fee, and allow cards to remain open indefinitely.

Card expiry balance forfeiture: if you keep a balance on your travel card past the expiry date on the card, ANZ, Travelex and Commonwealth Bank will zero your balance and keep it for themselves. American Express Global Travel Card is more ethical on this point -- it holds the money in trust until the cardmember claims it, even if the card is expired.

Account closure fee: if you complete your trip and decide you want to get your money out of the card again and back as Australian dollars, you can close your account and convert the money back at the current exchange rate. Travelex is the only provider that also charges an additional $10 fee for this.

How the travel money cards differ

Apart from the differences in fees outlined above, some of the cards do have some unique features:

Multiple currencies on one card: Commonwealth Bank is the only travel card provider that allows you to load up to six currencies onto one card.

You can put different amounts of money into each currency, and when you spend money in each country, it's deducted from the appropriate currency balance.

If you run out of money in the right currency, the card will fall back to another currency, but you will be charged a wrong currency conversion fee of 2% (still cheaper than the 3% - 3.5% fee charged on most credit cards.)

However, if you are organised, you can ring Commonwealth Bank and transfer money from one currency to another at no charge, which is a fantastic benefit.

The other travel card providers require you to buy a separate card for each currency you want to take on a trip, which, at $15 a pop, could be the monetary equivalent of a cafe lunch for two that you could save by going with Commonwealth Bank. (You can, however, avoid paying a card fee for Travelex Cash Passport or American Express Global Travel cards if you buy them at Australia Post.)

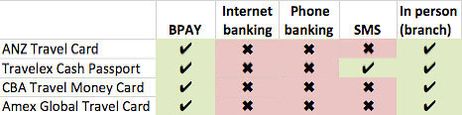

Methods for reloading the card: Ease of adding more money to your card while travelling is important. The weakest card in this respect is American Express Global Travel Card, which can only be recharged via an American Express Foreign Exchange Office in Australia, or via BPAY, which has a delay of several days.

Travelex has an SMS recharge system, where you send a text message while overseas, and they direct debit your bank account based on an authorisation you give them when you first set up the card. However, this method still takes up to two days.

All the cards offer reloading via BPAY, which provides a convenient option for anyone with internet or phone banking, however all the card providers warn this can take 2-3 days for funds to be credited.

Branch reloads can only be done at Australian branches for all cards.

Currencies available: some cards have a better range of currencies available than others. The weakest is the American Express Global Travel Card, which only offers US dollars (USD), Great Britain Pound (GBP) and Euro (EUR).

The best is the Commonwealth Bank Global Money Travel Card, which offers those, plus Japanese Yen (JPY), New Zealand Dollar (NZD), Hong Kong Dollar (HKD), Canadian Dollar (CAD) and Singapore Dollar (SGD).

If you need to go to a place which uses a currency not offered by any of the cards (for example China RMB, or Thai Baht) you can still use a travel money card, however you will just pay a "wrong currency conversion fee" each time you use the card -- 2-3% of the transaction amount for ANZ, CBA and Amex, and a hefty 8.45% for Travelex. In these circumstances, a better choice would be the international fee-free 28 degrees Mastercard, which we've explained extensively here.

Exchange rates

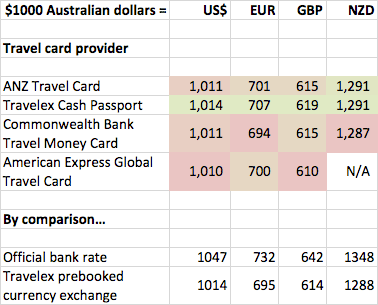

We checked the exchange rates on 8th April 2011 for purchasing US dollars, Euros, British Pounds and New Zealand Dollars for all the travel card providers.

All the providers were very competitive with each other, with rates that were similar to the rate you get if you pre-book cash to pick up from Travelex (one of the cheapest ways to buy currency). There was little difference between the cards in terms of exchange rate on the day we checked.

(Green/larger numbers are better)

Australian Business Traveller's recommendations

What to buy

If you're visiting a single country: ANZ Travel Card has a low $11 upfront fee, and has the advantage for ANZ customers of being linked to internet and phone banking so that more money can easily and instantly be transferred into the card. If you need Japanese Yen or Singapore Dollars, the ANZ card doesn't offer them, so you should go for the Commonwealth Bank card instead.

If you're visiting multiple countries: It's hard to go past the convenience of the Commonwealth Bank Travel Money Card, which can store up to six currencies on one card, saving you the cost of purchasing multiple cards for each currency. You can also shift money between the currencies free of charge, which is a fantastic service.

About the rest

American Express Global Travel Card is let down by a lack of options for adding more funds to the card during the trip, and the "American Express surcharge" that you will be charged in many shops and restaurants. There are some upsides to the American Express card -- there is no 'monthly inactivity' fee after 12 months, and the ATM withdrawal fees for the US and Britain are the cheapest of all the cards.

Travelex Cash Passport provides the best exchange rate and a convenient SMS reloading option if you need to put more currency on it, but you have to be very careful in using it, because if you buy in a currency other than the one you've loaded onto the card, you'll lose 8.45% of every transaction. Travelex also charges a $10 fee to get your money back off the card if you have money left over at the end of the trip, and if you leave your card unused after 12 months, Travelex will gradually fritter the money away with monthly fees.

How travel money cards compare to credit/ATM cards

Almost all credit cards charge 3 - 3.5% on top of all foreign purchases (that's $30 - $35 on $1,000), while travel money cards do not charge any surcharge on purchases made on the card -- as long as you spend in the right currency.

If you buy something in a currency other than the one you loaded on the card, you'll pay a conversion surcharge, but it is usually lower than the 3 - 3.5% charged on regular credit cards. For example, Commonwealth Bank only charges 2%. Travelex Cash Passport is an exception to this rule, though, slugging wrong currency purchases a whopping 8.45% penalty fee.

In terms of ATM cash withdrawals, normal Australian bank accounts and credit cards charge around 3% of the withdrawal amount plus $5 each time (for example, an $11 fee for a $200 withdrawal).

Preloaded travel money cards do not charge a percentage surcharge if you withdraw the currency you've loaded onto the card, but they do charge a flat ATM withdrawal fee -- in the range of US$2.00 - US$3.75 for a US dollar withdrawal, for example. So they are a bit cheaper for withdrawing cash than standard Australian credit/ATM cards.

One inescapable gotcha that applies to both standard ATM and preloaded travel money cards is foreign ATM operator fees. These can be as high as $15 per transaction if the ATM is in the lobby of a five star hotel, for example.

Unfortunately laws vary from country to country on whether ATM operators are required to warn you of these fees before proceeding with your transaction -- Australian Business Traveller staff have been stung without warning by a $15 fee using an English-language ATM in a five star hotel in China.

This fee applies whether it's a travel money card or a standard ATM card used in the withdrawal, so the two are comparable on this point.

It is worth noting that there is one credit card and one debit card on the market that allow fee free ATM withdrawals overseas, and do not charge any surcharge for international transactions. Read our writeup of the GE Finance 28 degrees Mastercard and NAB Gold Visa Debit.

The downsides of these cards are that there is a greater potential for fraud than with the limited balance stored on a travel money card, and the exchange rate fluctuates on a daily basis. However, they are otherwise cheaper to use than preloaded travel money cards.

How travel money cards compare to exchanging cash

Travel money cards are roughly comparable to the exchange rate you get if you pre-book a cash exchange from Travelex.

However, they have the advantage of being able to be easily replaced if you lose them, whereas replacing cash will require a travel insurance claim (if the policy even covers it) which can take many weeks to process.

Travel money cards are generally issued in pairs so you can keep one in your wallet, and one in a hotel room safe. If the first one is stolen, it can be deactivated without deactivating the second card, which has a different card number and PIN number.

They also have the advantage of only having a limited amount of money on them. If your card is skimmed and used fraudulently elsewhere, the amount of money you will lose is limited to the amount you've loaded onto the card.

However, unlike cash, which is always accepted everywhere and without any additional fees, Travel Money Cards will not be accepted by vendors that don't take credit cards, and if you want to get cash out at an ATM, you will have to pay some fees.

Beware, though, exchanging cash is only a good value option if you pre-arrange it. If you walk up to a change bureau, it can be very expensive.

In our investigation of the cheapest currency exchange outlets in Australia earlier this year, we found that when buying £1000, the cost in Aussie dollars could be as little as $1696.65 (at Flight Centre Money Centre) or as much as $1916.00 (using the Travelex change booth at Sydney International Airport). That's a difference of almost $220!

Qf

17 Apr 2011

Total posts 3

One card that stands head and shoulders above all others in my experience is the 28 Degrees MasterCard, (www.28degreescard.com.au), which has no initial purchase fee, no international ATM fees, no reload fee and no international transaction fees on purchases.

Qantas

24 Oct 2010

Total posts 177

Yes that's also a very good option -- we wrote about it here...

28 degrees Mastercard - the best credit card to take overseas?

27 Jul 2011

Total posts 1

I just rang Commonwealth Bank and they stated one cannot load money direct from Netbank onto the card. The only loading methods are Bpay or at a branch.

22 Mar 2012

Total posts 1

I applied for this card and then spoke to a representative of GE. I stated that I'd applied for the card on the basis of the comments on this page, and I wanted to pay cash onto the card and then use it like a debit card when I travel to Thailand next week. The response I received surprised me: I was told that the card could be blocked while I am overseas (as can happen with other credit cards) and that the comments on this page are not accurate.

Have others used this card in the manner I've described - i.e. paid money onto the card and used their own money o/s without using the credit balance on the card? Do the advantages listed above bear out in the use of the card?

20 Feb 2012

Total posts 67

Hi, The only thing I have been told by GE is that any money in credit is not covered by Fraud protection. I have been using the card as above for years.

26 Nov 2011

Total posts 3

Yes.. i recently went overseas.. and before i left.. i BPAY $500 into my 28Degree Credit Card and withdraw the money while i was overseas... worked like a charm.. and no fees apart from the conversation rate.!!

Qf

17 Apr 2011

Total posts 3

I'm surprised to read Mirrella's comment and that GE are apparently prepared to diss their own product. I use this card as my staple to withdraw funds when overseas - most recently in HK two weeks ago - but I've also used it throughout Spain, France, Italy and never a problem. It's always in credit because I don't want to pay the horrendous intrest charges. I guess it could be blocked, but so could every other card - seems kind of dumb for GE to be saying this to a potential client.

24 Apr 2012

Total posts 5

Have you looked at the "Cash Passport" (https://www.cashpassport.com/1/en/au/) for comparison?

thanks!

24 Apr 2012

Total posts 5

Hello, I've just worked out that this card - although it's got Heritage Bank stamped over it - is really the Travelex card that's already been reviewed! Silly me!

24 Apr 2012

Total posts 5

I see that there are four different cards available as "Cashpassport" - a Mastercard and three Visa cards. And the Mastercard has a different exchange rate to the Visa I tested - about 1% better in my favour!

28 Apr 2012

Total posts 1

As usual the devil is in the detail. The commonwealth cards let you preload currency and has cheap atm fees and no conversion fees but the catch is the initial buy rate which skims 5.7% over the wholesale rate. Mastercard charges a wholesale rate then 3% conversion. Commonwealth was offering 74.49 AUD to EUR mastercard was 78.5. Link www.mastercard.com/global/currencyconversion/index.html . I haven't found whether the wholesale or retail rate applies to the good old keycard the commonwealth bank provides. As Mastercard does the conversion I assume it is the wholesale rate. ( They sting $5 aud + 3% for a cash withdrawl. Using a 600 EUR withdrawl as an example, the cost by keycard inc the $5 fee would be $792.26, to prepurchase the same 600 EUR on the CBA Travelmoney card would cost $820 ($15 up front for the card).

At 200 EUR its still about $1 cheaper to go with the old keycard.

The message here is, the banks aint doing you any favours, just trying new ways to mess with your head and cash.

08 May 2012

Total posts 1

While ANZ do have a single currency card they also have a multiple currency card available as well. You can move money between currencies online if you get your amounts wrong. I usually have it loaded into Australian dollars and then migrate whats needed into the foreign currency closer to the need. There's no charge for moving from Australian dollars already loaded but there is a hit for moving between other currencies.

08 May 2012

Total posts 1

Hey I did read above but I'm really not good with all this banking stuff. What do you think is the best bank/card for a 20 year old travelling to South America - where it's all different currencys? I'm currently with CBA. Thanks!

14 Jul 2012

Total posts 1

"Multiple currencies on one card: Commonwealth Bank is the only travel card provider that allows you to load up to six currencies onto one card."

Wrong !

Cash Passport allows up to 10 currencies on one card.

03 Jan 2012

Total posts 96

Dan, I'm not sure about the other cards, but the Commonwealth actually give you two cards - so one is a spare in case the primary card is lost, damaged or stolen. That's pretty useful for international travellers. Another tip to cheapen the cost is to just ask for a new card anytime you're going to load up more than AUD$1,500. Since the up front free is only 15 bucks but the re-charge fee is 1 percent of the total load, and you get one free upload, you'll save a decent percentage each time if you're putting a few thousand on the card. For more tips, you can check this review about the Commonwealth card - https://www.therisktoolboxshop.com/_blog/The_Risk_Management_Tool_Box_Blog/post/Journey_Management_Security/

Qantas - Qantas Frequent Flyer

03 Jul 2011

Total posts 187

BankWest now have a Rewards Transaction account, that allows for FF points with VirginAustralia, no overseas ATM fees (exchange % fee still applies), and reading the fine print - no ATM fees at any Aussie ATM.

https://www.bankwest.com.au/personal/everyday-accounts/everyday-transaction-accounts/rewards-transaction-account

04 Dec 2012

Total posts 1

Travellex Cashpassport Prepaid Visa Single Currency

I have ordered single currency cashpassport card in US dollars.

Initial Load to US Dollars was free

Subsequent load $1000 they took $50 fee

I did not even notice until I was asked in USA that card does not have embossed/raised numbers!

Reno Nevada- 95% cab drivers refused to take this card!

San Francisco California a little better

Los Angeles-some problems due to the numbers not embossed

Las Vegas-little better, but a large casino/hotel I stayed in -The Venetian have also flat out refused the card even when I offered ID.

Overall experience-NOT GOOD.

Would never use this company.

My advice go with the big four bank.

ANZ/Commonwealth/NAB all offer same card with embossed numbers and/or your name imprinted.

And as far as I heard ANZ is best of all....

23 Feb 2013

Total posts 1

NAB gold debit card no longer gives you fee free O/S ATM withdrawals and free currency conversion, this changed August 2012.

11 Apr 2013

Total posts 1

I had the GE Mastercard for a trip to Thailand a few years ago. I loaded $5000 unto it before I left. In Thailand I could not get cash advances from ATMs and had to make many phone calls to GE about this. I was told that I could only take out $500 one time because there was a limit on cash advances! So I was unable to acess my money for the entire trip. It took me months to get my money back when I returned home. It was the most frustrating travel experience I have ever had!

08 Aug 2013

Total posts 1

Have you reviewed the Australia Post Load and Go Travel Card? I can't find any info on this?? It was receommended to me by my travel agent.

Qantas - Qantas Frequent Flyer

19 Oct 2013

Total posts 1

Commonwealth's Travel Money card does NOT work in Japan. I tried 7 or 8 different ATM's around Shinjuku (including 2 Seven Elevens) and not one of them was able to process the card. I couldn't even pay for my hotel fee (can't be used as a guarantee for rooms either). FYI, you won’t be able to contact the Travel Money Card help line directly via Skype which can make obtaining any assistance difficult when overseas. I had to call the international general enquiries number and they had to patch me through. When I finally got through to someone with the knowledge to help they basically said the card doesn’t work in Japan. I had to find a post office to withdraw cash which are only open between 9am and 4pm, Monday to Friday (too bad if you need cash on the weekend!!!). Anyway, I had to pay my hotel bill in cash. I would not recommend using the Commonwealth Travel Money Card in Tokyo.

31 Oct 2015

Total posts 1

Have just returned from a 6 week road trip in the USA. The biggest mistake I made was thinking a Travelex Multi Currency Cash Passport would be a good way to carry my funds. I ran out of available funds as a result of uncleared pre-authorisations made by hotels, cruise lines, car rental companies etc etc.

I ended up loading up my 28 Degrees to save the situation.

Yes, you can use a credit card to guarantee bookings then pay final amount on the debit card but this generally confuses checkout staff and only worked in two out of three situations that I tried this go around.

Cards such as Travelex Multi Currency Cash Passport do not give you the "convenience" they promise. Avoid!

Hi Guest, join in the discussion on Reviews & compared: the best travel money cards in Australia