Top five credit cards for earning points on tax payments in 2017

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Nobody likes paying tax, but using the right credit card to pay your dues – including income tax obligations and HECS debt repayments – could deliver you a bounty of Qantas or Virgin Australia frequent flyer points.

Savvy business owners can use their business or corporate credit card to settle the company’s BAS and PAYG obligations for an even greater points haul.

But there’s one important caveat: not all Aussie credit cards earn frequent flyer points on tax payments. In fact, some credits cards provide points at significantly reduced rates compared to ordinary transactions.

Given that you’ll pay a 0.54% surcharge on all Visa and MasterCard tax payments and a 1.45% fee on all American Express ATO charges, Australian Business Traveller highlights five of the best cards for making the most of your next tax bill, including how many points you can earn and what you’ll pay in annual fees.

1. Commonwealth Bank Business Platinum Awards American Express

ABN holders can pocket up to 1.5 Virgin Australia Velocity frequent flyer points per dollar spent with the ATO via the Commonwealth Bank Business Platinum Awards American Express, or a still-reasonable 1.2 Qantas Points per dollar spent when opting for Qantas Points instead.

There’s an annual fee of $300 to pay – plus an extra $30 per year if choosing Qantas Points – but in return you’ll also get a CBA Business Platinum Awards MasterCard at no extra charge, earning either 0.4 Qantas Points or 0.5 Velocity points per dollar on all spend, including with the ATO.

A total points cap of 300,000 Commonwealth Awards points applies per calendar year across the total spend of both cards, equal to 150,000 Velocity points when converted on a 2:1 basis, or 120,000 Qantas Points when converted automatically every month.

2. Qantas American Express Discovery, American Express Velocity Escape

Looking to pay your income tax or make a HECS debt repayment? Both the Qantas American Express Discovery Card and American Express Velocity Escape Card serve up one frequent flyer point per dollar spent with either Qantas or Velocity, as applicable.

That includes payments to the Tax Office, along with other government charges, insurance and utility costs and on all remaining spend, with no annual fees to pay and no monthly or annual points capping to contend with, either.

3. St. George Amplify Signature Visa

Whip out a St. George Amplify Signature Visa and you could earn up to 0.825 frequent flyer points per dollar paid to the tax man with airlines such as Qantas, Virgin Australia, Singapore Airlines and Malaysia Airlines – and with no points capping, provided the card is used for personal charges only.

It works like this: choose ‘Amplify Qantas’ rewards and you’ll initially earn 0.75 Qantas Points per dollar spent, and when your birthday rolls around, you’ll earn a ‘birthday bonus’ of 10% of the points you’ve earned in the past year, taking your total haul to 0.825 Qantas Points per dollar.

Similarly, choose ‘Amplify Rewards’ to earn 1.5 Amplify points per dollar (equal to 0.75 frequent flyer points with those other airlines) and you’ll also earn a 10% bonus when cutting your birthday cake, with an annual fee of $279 covering both rewards options.

4. Westpac Altitude Black American Express

While many Australian banks no longer award points on credit card tax payments, Westpac continues to offer these, just at a lower rate per dollar than for regular spend.

Accordingly, Altitude Black AMEX cardholders pick up either 0.75 Qantas Points per dollar or the equivalent of 0.75 Velocity Points, 0.75 Malaysia Airlines Enrich miles, 0.6 Singapore Airlines KrisFlyer miles or 0.6 Cathay Pacific Asia Miles via the bank’s Altitude Rewards program.

Cardholders pay an annual fee of $395 which also includes a companion Altitude Black MasterCard, yet the MasterCard earns no points on tax payments, so stick to paying by AMEX if this is your bank of choice.

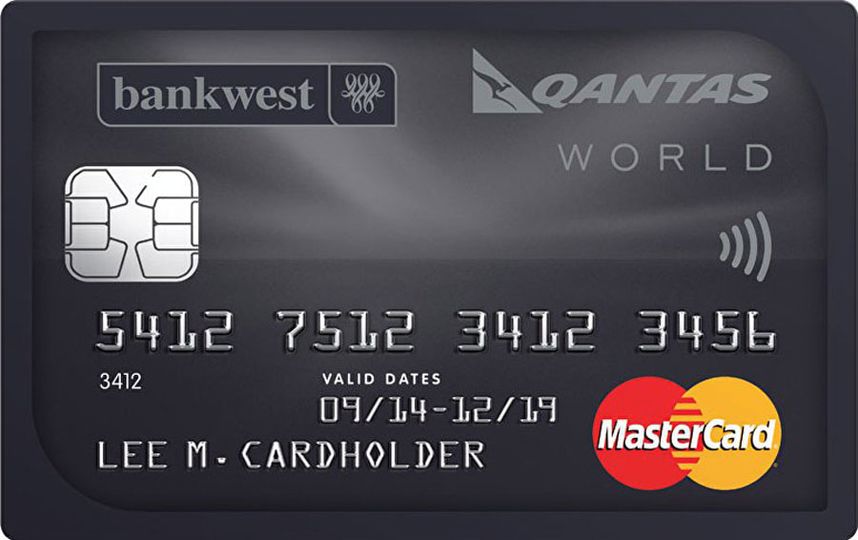

5. Bankwest Qantas World MasterCard

Pay your tax bills with a Bankwest Qantas World MasterCard and you could scoop up 0.66 Qantas Points per dollar spent, uncapped.

This formerly-‘secret’ card has long been a favourite of existing Bankwest customers, but can now be applied for by members of the general public: including those who don’t already bank with Bankwest.

There’s a $270 annual fee, but in the same token, the ATO’s surcharge on MasterCard payments (0.54%) is significantly lower than billed on American Express transactions (1.45%) – so you’ll pay less in fees on every dollar of tax you contribute.

Also read: Top-up your points this January with the top five credit card sign-up deals

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Qantas - Qantas Frequent Flyer

29 May 2013

Total posts 69

My ANZ Rewards Black amex gives me 3 MR points (1.5 VFF points) per dollar and the visa 1.5 MR points (0.75 VFF points) with payments to ATO. Plus I also earn points on the surcharge too.

24 Apr 2012

Total posts 2424

As of February 27 last year, ANZ changed its credit card T&Cs to inhibit points from being earned on all ATO payments. If your account was 'missed' during that change, I'd not be shouting that from the rooftops. ;)

Qantas

15 Jun 2016

Total posts 14

My Amex black card from a big 4 still gives 1.5 per $1 on tax payments - but not sure if they still issue this version

04 Apr 2016

Total posts 2

Hi Chris,

06 Jul 2017

Total posts 1

Do you have an update on this as at July 17? Just found out my westpac Black Amex cancelled all ATO benefits...

24 Apr 2012

Total posts 2424

Hi Damo, not at this stage but it's certainly on our list for consideration once all of the banks have completed rolling through their various changes.

10 Jul 2017

Total posts 32

Does the St George Signature Visa still earn points for ATO spend?

Hi Guest, join in the discussion on Top five credit cards for earning points on tax payments in 2017