What could you do with 75,000 bonus Qantas frequent flyer points?

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

ANZ’s offer of 75,000 bonus Qantas Points attached to its Frequent Flyer Black Visa credit card has been around for a while, but it’s still a generous deal, and there are plenty of good ways to put those points to good use.

Right off the bat, that 75k bonus could unlock:

- a return Qantas business class trip between Auckland and Sydney, Melbourne or Brisbane; or

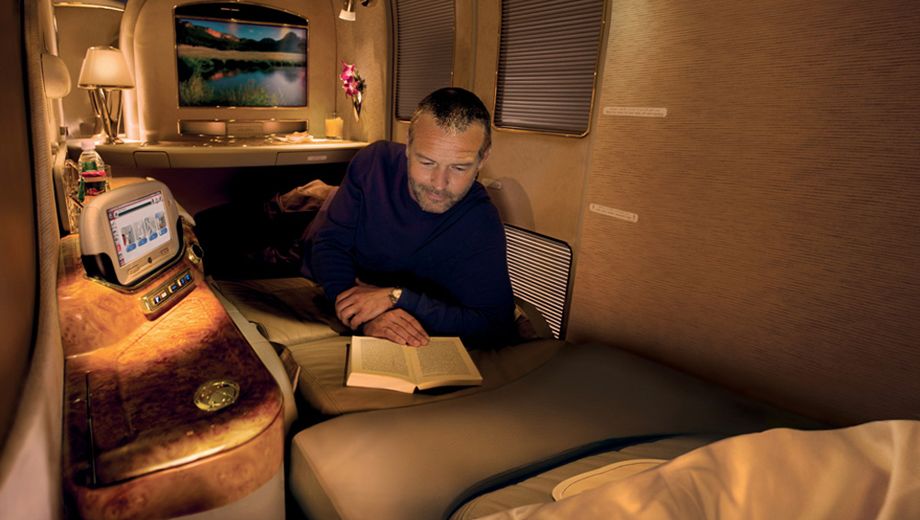

- a one-way Emirates first class flight from Sydney to Christchurch, returning home in economy; or

- a return upgrade on flights between Sydney, Melbourne or Brisbane and Los Angeles, bumping up from flexible economy to premium economy in one direction and from flexible economy to business class the other way, plus a one-way upgrade from flexi economy to business class on a short domestic flight like Sydney-Melbourne, with 2,500 points to spare; or

- a one-way business class ticket on Qantas’ longer flights to Asia, such as Sydney to Tokyo, Beijing or Shanghai, with 3,000 points to spare; or

- an impressive seven one-way upgrades from flexible economy to business class on cross-country flights, such as between Perth and Sydney, Melbourne and Brisbane, or three upgrades on the same routes on lower-priced tickets.

What’s more, with no annual fee to pay in the first year and the opportunity to save up to $497 on the first year of paid Qantas Club membership, you’ll be firmly ahead from the get-go.

Here’s what you need to know to take advantage of ANZ’s generous sign-up offer.

ANZ Frequent Flyer Black Visa: earn 75,000 bonus Qantas Points

Take home those 75,000 bonus Qantas Points when you apply for the ANZ Frequent Flyer Black Visa and spend $2,500 on ‘eligible purchases’ within three months of card approval.

ANZ notes that “Eligible Purchase means purchases which are eligible to earn Points”, which excludes things such as “fees, cash, cash equivalent transactions, balance transfers, premiums paid for ANZ Credit Card Insurance and transactions for gambling or gaming purposes”, for example.

The bank also points out that the offer isn’t available to those transferring from an existing ANZ credit card, or for customers who “currently hold or have closed an ANZ Frequent Flyer, ANZ Frequent Flyer Gold, ANZ Frequent Flyer Platinum or ANZ Frequent Flyer Black credit card within the previous twelve months.”

After the first year, a total annual fee of $425 applies.

ANZ Frequent Flyer Black Visa: extra points and perks

Even after you’ve pocketed that sign-up bonus, you’ll continue earning points at a reasonable rate, reeling in one Qantas Point per $1 spent up to and including $7,500 per month, and 0.5 Qantas Points per $1 spent thereafter, uncapped.

Transactions made directly with Qantas – such as flight bookings in Australian dollars or using your card to pay for or renew Qantas Club membership – also churn out an extra Qantas Point per $1 spent, giving you up to two Qantas Points per dollar spent on those charges.

The card also includes two complimentary Qantas lounge invitations every year, which can be used to access domestic Qantas Club lounges or international Qantas business class lounges (except Los Angeles) when travelling onwards with Qantas or Jetstar.

You could use these invitations to get a taste of the lounges before paying for an ongoing membership, or if you’re already a Gold or Platinum frequent flyer – or take up that paid Qantas Club membership – you could use the passes to bring extra guests into a lounge instead, or gift them to friends and family.

For more information or to apply for the Frequent Flyer Black Visa, head to the ANZ website.

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.