Cheaper than a Gulfstream, nimbler than a superyacht, a second passport – or a third, or fourth - has become another trophy for the ultra-wealthy.

Even self-styled citizens of the world, it seems, need a Plan B. Plus, that gold Maltese coat of arms looks classy. One must keep up, after all.

Wealthy buyers “are looking for security” said Christian Kalin, chairman of Henley & Partners, which provides citizenship advice and publishes rankings such as the Quality of Nationality Index (France is No. 1). They want peace of mind in case of a revolution or other upheaval in their home countries, he said.

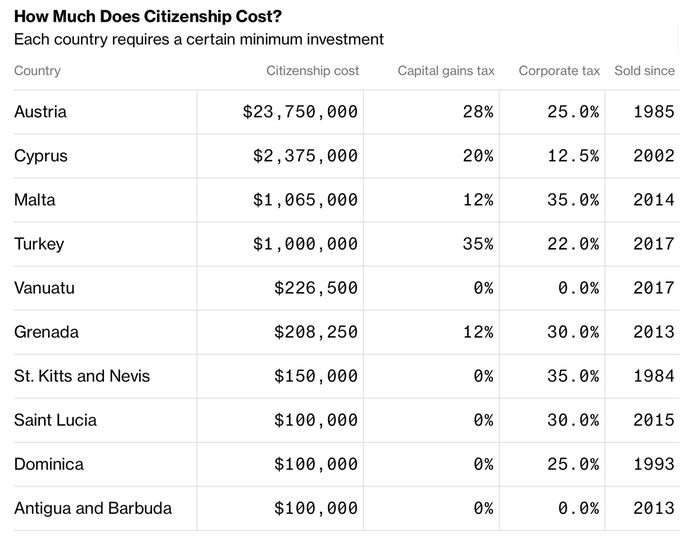

While many nations, the U.S. included, allow legal residents the chance to apply for citizenship after meeting certain criteria, only 10 countries permit outsiders to acquire citizenship outright. Most require payment in the form of a direct investment, typically in property or a local business.

Conveniently, eight of them are classified by the IMF as offshore financial centers, though Kalin said stability, not tax avoidance, is what motivates most buyers. That and bragging rights.

“If you have a yacht and two airplanes, the next thing to get is a Maltese passport,” he said. “It’s the latest status symbol. We’ve had clients who simply like to collect a few."

But not all pay-for-your-passport deals are created equal.

The hefty US$23.75 million to become a citizen of Austria requires you to actively invest in the local economy, although as your Austrian citizenship falls under the government’s privacy laws it isn’t published or reported anywhere, not even to other countries.

As a member of the Commonwealth of Nations, Grenada’s citizens have visa-free access to 141 countries, including China.

Newly-minted citizens of Saint Lucia – a process which costs is a steal at just US$100,000 – aren’t even required to live there or even visit.

Malta imposes no taxes on your worldwide income or assets, although money brought into the country is taxed at a flat 15 percent.

But Vanuatu could take the cake for value: the South Pacific island-nation levies no personal, corporate, estate or capital gains taxes, while its government website advertises the country as as “a great tax haven.”