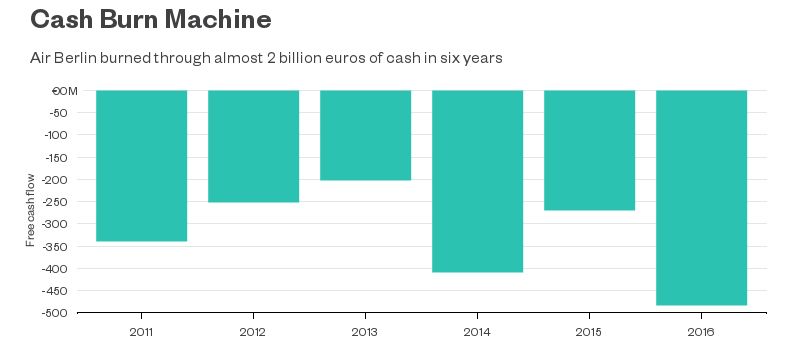

If you want to know why Air Berlin has filed for insolvency protection, look at this chart of the airline's free cash flow. Those numbers are all negative and they add up to minus-€2 billion (minus-US$2.3 billion).

That wasn't insurmountable when anchor shareholder Etihad Airways was propping up the company.

But on Tuesday, Etihad, which has a 29 percent stake and supplies plenty of debt financing, effectively pulled the plug. It won't provide any more financial help and its two representatives have quit Air Berlin's board.

Air Berlin's collapse is alarming for its almost 9,000 employees, but it's been a long time coming.

The company has about €1.2 billion in net debt and minus-€1.8 billion of shareholder equity, according to Bloomberg data.

Compared to budget carriers such as Ryanair and EasyJet, which are busy adding capacity and cutting fares, Air Berlin's cost base was simply too high.

Gulf carriers like Eithad were once feared in Europe but they're struggling now.

Etihad's strategy of buying minority stakes in various far-flung airlines appears to have been particularly ill-conceived: the Abu Dhabi hub carrier reported a US$1.9 billion loss for its 2017 fiscal year. Another Eithad investment, Alitalia, filed for bankruptcy in May.

In theory, these airline failures should be an opportunity for the needed consolidation of Europe's skies, which are far more fragmented than in the U.S. It makes European airlines susceptible to adding too much capacity, at little profit.

The five biggest carriers on the continent control just 46 percent of the market, whereas in the U.S. just four carriers have a stranglehold on more than two-thirds of the domestic market.

But don't bet on things changing in a hurry. Lufthansa hopes to profit from its rival's troubles and has already leased some of its planes for its own new low-cost airline, Eurowings.

The German government, perhaps conscious of federal elections next month, has offered Air Berlin a bridging loan.

Ryanair and its ilk will be scouring for opportunities too to push into the German market. The Irish carrier is one of several airlines to have submitted non-binding bids for Alitalia.

That could mean Europe's oversupply of airline seats ends up being preserved – albeit at airlines with stronger balance sheets. Expect more of the same rather than up, up and away.

Qantas - Qantas Frequent Flyer

21 Jan 2017

Total posts 51

the Irish really know how to run airlines :p

Qantas - Qantas Frequent Flyer

11 Oct 2014

Total posts 688

"But don't bet on things changing in a hurry. Lufthansa hopes to profit from its rival's troubles and has already leased some of its planes for its own new low-cost airline, Eurowings.

The German government, perhaps conscious of federal elections next month, has offered Air Berlin a bridging loan."

Needless to say, Air Berlin has been a problem-child for a significant period of time. Hence the original Etihad fund injection which sought to capitalise on the reasonably healthy German-US Air Berlin market, but which also would have provided EY a nice back-door for further European expansion by stealth.

However, surely the questions that should be asked are more about consolidation (gee, Lufthansa and its stable of German / Austrian fortresses ie: LH, Swiss, Austrian, Germanwings etc) and more importantly, why Germany seems unable to support two (2) competing carriers? Queue the issue of LH consolidation, and the German Government's enthusiastic response to providing a bridging loan to a now bankrupt carrier.

31 Mar 2016

Total posts 619

kimshep:

Qantas - Qantas Frequent Flyer

20 Aug 2012

Total posts 124

Reminds me of an Australian airline that requires constant cash injections by foreign airlines (including Etihad) to prop itself up.

Qantas - Qantas Frequent Flyer

17 Aug 2016

Total posts 23

But that Australian airline u speak of has now got a positive Cashflow where air Berlin does. It and it where the problem lies

Qantas - Qantas Frequent Flyer

15 Jun 2016

Total posts 5

Another loss to One World. Now all that remains in Europe is BA.

Qantas - Qantas Frequent Flyer

15 Jun 2016

Total posts 5

Sorry BA & its very limited vassal airlines Iberia and Aer Lingus

Qantas - Qantas Frequent Flyer

11 Oct 2014

Total posts 688

It's somewhat difficult to feel sympathy for an otherwise excellent oneworld when it's problems originate from it's own blinkered attitude. Both Star Alliance and SkyTeam include single cabin / low cost carriers into their alliances. oneworld does not. Simply because oneworld treasures its appeal to Business travellers.

In the real world, the travel market consists of all manner of travellers. 'Smart' alliances tailor their alliance efforts to cover all these while still managing to restrict their perks to Business and tiered travellers.

The sooner oneworld chooses to revise their arcane market view, the better off we will all be. That would then allow the likes of Vueling, numerous LAN subsidiaries as well as Fiji Airways and Jetstar to join the alliance which their respective 'parents' are part of. Hell, even QF has found a way for JQ to offer QF points (at cost). How hard can it be?

Hi Guest, join in the discussion on Air Berlin's magnificent flying cash burn machine