Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

The Commonwealth Bank is tweaking the complimentary international travel insurance offered with its range of Gold, Platinum and Diamond Awards credit cards from July 1 2015 to become more ‘frequent flyer friendly’ across the board.

For starters, cardholders will no longer need to pre-pay at least A$1,000 worth of travel expenses such as airfares and hotel nights using their CBA cards to qualify for cover.

Instead, overseas medical and personal liability insurance is automatically yours regardless of how your ticket is booked.

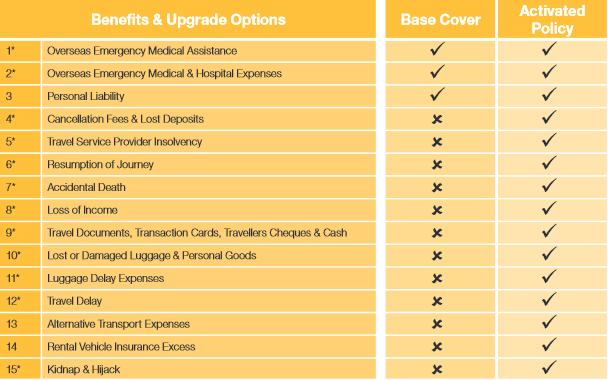

Additional cover such as for travel delays, lost luggage, loss of income and accidental death is also extended at no extra cost, but you’ll need to advise CBA of your travel plans via NetBank for the new 'Activated Policy' to take effect.

That allows travellers who book their journey using frequent flyer points – or are travelling on tickets booked by their employer – to be covered under the bank’s free insurance deal, which may not have been possible or achievable under the previous insurance policy.

There’s also the option to upgrade your cover at an additional charge via NetBank, should you have a pre-existing medical condition, be participating in snow sports or require additional rental vehicle excess cover, and more:

Whichever option is chosen, you’ll receive a Certificate of Insurance after registering your travel which can also assist with certain international visa applications.

As part of the change, CBA is switching insurance providers from Zurich to Allianz from the same date, with the latter seemingly offering a comparable level of cover.

One exception to the rule is how cancelled trips are handled when flights were booked using frequent flyer points.

Where these circumstances are covered by the policy, Allianz calculates the worth of each point based on the financial cost of booking a similar ticket with cash in the same class of service.

You’d then receive the equivalent value in cash – or on a pro-rata basis if your journey had already commenced – but be sure to register your travel plans before every overseas trip or this, and many other aspects of the insurance, won’t apply.

Forgetful travellers can still register their itinerary after leaving Australia but would be subjected to a three-day waiting period before benefits of the ‘Activated Policy’ kick in.

Earlier this year, CBA also reduced the annual fees on its range of Awards cards, with Diamond Awards dropping from $425 to $349 each year, Platinum from $289 to $249 and Gold from $144 to $119, while the basic Awards card, sans insurance, was lowered from $89 to $59.

For more information, head to the Commonwealth Bank website.

Also read: How to maximise your Commonwealth Awards points

Follow Australian Business Traveller on Twitter: we're @AusBT

Disclaimer

Executive Traveller may receive a commission when you apply for these credit cards via our links.

The information provided on this page is purely factual and general in nature. You should seek independent advice and consider your own personal circumstances before applying for any financial product.

Qantas - Qantas Frequent Flyer

19 Nov 2011

Total posts 243

It's great news for travellers but the fees and charges other than the annual fees are ridiculous.

QFF

19 Sep 2013

Total posts 209

And it doesn't cover the excess car rental charges that other travel insurance policies provide.

24 Apr 2012

Total posts 2424

CBA's Activated Policy does provide for 'Rental Vehicle Insurance Excess' as above – you'll just need to check the PDS to see if the cover is suitable for your needs.

Skywards Gold

21 Apr 2011

Total posts 53

Any idea what the excess would be on this policy? Also how do the levels of cover compare to say covermore?

24 Apr 2012

Total posts 2424

As different excesses and levels of cover apply in different scenarios and to different cardholders, you'll find them all listed in the PDS which can be obtained via the CBA website.

17 Jun 2015

Total posts 1

Good news but Still have foreign transaction fees?

Qantas - Qantas Frequent Flyer

10 Nov 2012

Total posts 26

Right now I'm regretting not reading this article - and the fine print on the policy - earlier. Transit cover is a concern for me - after a former colleague had a big smash on the way to the airport.

The PDS says: "This cover is available on trips where prior to the trip, the entire payment for the trip was charged to the cardholder’s eligible credit card account."

I'm not sure what the "entire payment for trip" means, but it sounds like it includes everything - fares, hotels, etc. I've used frequent flyer points for part of the trip I'm on now, and so have - I'm assuming - zero Transit cover. Even if I do, if I decide mid-trip to change my itinerary, I might not be covered as the entire payment wasn't made "prior to the trip." A key part of the charge would have happened during the trip.

Only found out when I was reading the fine print. I'll rethink using this policy next time.

Hi Guest, join in the discussion on Commonwealth Bank shakes up free credit card travel insurance