Qantas' frequent flyer arm is now worth almost $4 billion

A once-unwanted Qantas division with no planes or passengers is turning into the Australian airline’s biggest money spinner.

Qantas’ frequent-flyer business, earmarked for sale at least twice, has delivered consistent growth since the airline’s historic loss in 2012. Now Chief Executive Officer Alan Joyce is hatching more ambitious plans for his most profitable unit.

Joyce expects the loyalty program’s earnings to almost double by 2022 as a revitalized Qantas sells air miles to a widening pool of companies, from credit-card operators to supermarkets.

The business is so central to Qantas that hitting the profit target could underpin a 50 percent jump in the stock price, First NZ Capital Securities said this week.

“More frequent-flyers means more retailers and other partners are interested, and that just builds upon itself,” said Adam Fleck, the Sydney-based director of research for Morningstar Inc. in Australia and a Qantas frequent flyer. “It ends up being a pretty valuable proposition.”

This is how it works: partners buy Qantas points to reward their own customers for their loyalty. The cost to Qantas of redeeming a point is less than the money it’s sold for, so Qantas makes money on every point. The points are typically redeemed after 24 months, so Qantas generates revenue years in advance.

Qantas fell 1.5 percent on Friday in Sydney trading. The stock is up 42 percent this year, valuing the company at A$8.6 billion.

Teeing up points

Almost 12 million members, or every second Australian household, amass points for travel and on purchases of everything from health insurance to wine – even a round of golf.

Credit Suisse Group AG estimates that business is worth almost A$4 billion, which is more than the Australian flag-carrier’s international business and double some valuations of the loyalty unit when its sale was contemplated in 2008.

Rather than function solely as a reward for flying on Qantas, the program is close to being the main draw, said Paul Nelson, founder and managing director of Sydney-based consultancy BrandMatters Pty. The appeal of membership is enough to stop many flyers shopping around for cheaper flights, he said.

The tail wagging the dog

“They’ve taken something that’s seen as being quite secondary and made it almost primary in decision-making terms,” Nelson said by phone. “It’s gone from the dog wagging the tail to the tail wagging the dog.”

To be sure, the 30-year-old frequent-flyer program is partly hostage to the appeal of Qantas as an airline. The carrier, the world’s third oldest, needs to make available sufficient redemption seats across a range of destinations for customers to see the value in accruing points.

While Qantas has bounced back to profit during a three-year turnaround, investors aren’t yet sure how the carrier would handle the next downturn.

At the same time, Qantas has lured millions of frequent flyers in recent years partly because it dominates local rival Virgin Australia, controlling about two thirds of the domestic market.

Virgin’s own loyalty program would appeal more if it could grab more of that share, according to Morningstar.

It was a different story a decade ago. Amid rising fuel prices and falling profit, Qantas planned to list the loyalty business. But the global financial crisis got in the way.

Joyce revisited the plan in 2014 as the airline posted a record loss of A$2.84 billion. Just last week, the 50-year-old, Irish-born executive told investors the loyalty business would never be sold.

A self-powered juggernaut

As a business, Qantas Loyalty is an air-miles juggernaut that feeds itself.

An online store sells everything from suitcases and sunglasses to shavers. Every new member who signs up and hunts for points creates an incentive for retailers to buy miles from Qantas to reward their own customers.

More than a third of credit-card spending in Australia – which totaled A$303 billion in 2016 – is on a Qantas co-branded card, according to the airline, and Qantas plans to grab a bigger share of that market with the release of its own credit card with Citigroup before July.

Frequent flyers earned more than 120 billion points and redeemed 4.9 million flights in 2016. Qantas, known as the Flying Kangaroo, carries around 51 million passengers a year.

Steady income

Divorced from selling tickets and carrying passengers, Qantas’s loyalty business generates steady income that smooths out the cyclical nature of aviation. At Qantas’s investor day last week, loyalty was the only business for which Qantas gave earnings forecasts.

It’s the airline’s only unit to report consecutive earnings growth since 2012.

Underlying operating profit at the business is on course to reach as much as A$600 million in 2022, from a record A$346 million in the year ended June 2016, Qantas said last week.

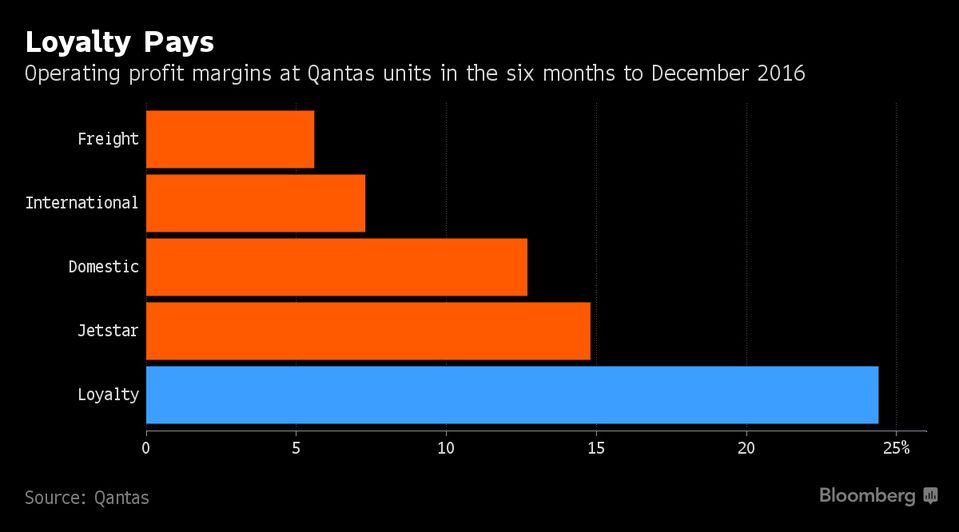

The unit’s most recently disclosed first-half profit margin of 24 percent makes it more than three times as profitable as the international aviation business and almost twice as lucrative as the domestic division.

By 2020, the loyalty division will be Qantas’s biggest contributor to profit, Bank of America said in a report last month. As an added bonus for Qantas, its loyalty memberships lapse after 18 months of no activity and the miles expire.

QANTAS

12 Jun 2014

Total posts 22

The main value I see in points is redeeming it for premium seats on the Kangaroo route. The massive downgrade in capacity moving to a 787 from an A380 will likely make it even more difficult to secure these seats than it is already. Instead of J or F now it'll be J seats so perhaps half the seats that were available previously.

Air New Zealand - Airpoints

05 Nov 2014

Total posts 66

To be precise, the Air Canada / Aeroplan debacle shows that Qantas Frequent Flyer is worthless.

04 Nov 2012

Total posts 212

And the outrageous fees and charges make up for much of the profit, should be outlawed.

Qantas - Qantas Frequent Flyer

21 Jan 2014

Total posts 321

Do not be surprised in the pursuit of savings and revenue the govt start to really crack down on FF points in regards to FBT as part of their black economy targets which have started. The govt currently miss out on FBT and GST in the process.

Qantas - Qantas Frequent Flyer

02 Jul 2011

Total posts 1374

FBT yes. GST they arguably already earn on the cost of the FF point embedded in the original ticket price.

Qantas - Qantas Frequent Flyer

26 May 2014

Total posts 463

FBT could only be applied to points earned by employer-paid travel. You then have a problem of deciding when a benefit is obtained. Is there a benefit from having points in an account ? Most tax payers would say no.

Qantas - Qantas Frequent Flyer

11 Oct 2014

Total posts 687

1. GST is not applicable on international travel with QF. That is printed on every QF e-ticket issued.

2. Air Canada has announced that their determination on the transferability of Aeroplan points into the new, unnamed AC FF program will be revealed next month (June). As the leading / dominant Canadian carrier, it would be extremely foolish to alienate a large swathe of the public by not providing some form of linkage .. or offering a radically poor transfer of points rate. OTOH, I would bet that some form of 'devaluation' may well occur, given that they will need to maintain status levels of existing Aeroplan / AC customers for 12 months or so.

Qantas - Qantas Frequent Flyer

11 Oct 2014

Total posts 687

What this Bloomberg article fails to realise though is that there are several issues that QF will need to confront and deal with.

While the program may have a stated "value of AUD $4b plus", that is only realised if the program is sold successfully. I don't fail to recognise the intrinsic value of the program as an aid to marketing, but we have seen QF management sensibly back off the sale of the program twice. To lose control of the program would be lethal. Precisely why Alan Joyce is now committing to the retention of the program permanently.

27 Apr 2017

Total posts 39

Excellent comments. It is amazing to think that the analyst did not consider these very obvious points of significant future risk for the profitability of QFF. On the availability of redemptions, as rcnr25 said above, we are about to see a major reduction in redemption availability Aus-LHR on QF metal.

05 May 2016

Total posts 616

I want to use points for J and F to/from LHR and this can certainly be expected to become more difficult from next year with the capacity greatly reduced. Ideally I'd like to be able to get more than 2 seats on points on the one flight to/from LHR sometimes but with only about 2 seats released that'd be pretty much impossible.

Qantas - Qantas Frequent Flyer

21 Jan 2014

Total posts 321

When goods are purchased from the Qantas store the govt misses GST, whilst small it is however significant in the current debate as they drop the GST threshold for overseas purchases. I would expect the whole FF scheme to be scrutinised further, it is effectively supplementing currency to avoid taxes and charges.

China Airlines - Dynasty Flyer

22 Sep 2012

Total posts 73

Qantas - Qantas Frequent Flyer

02 Jul 2011

Total posts 1374

Given many J seats are booked 1-2wks out that sounds very sensible planning.

05 May 2016

Total posts 616

I've tried several months out to get seats to/from LHR in peak season released on points in J and was unable to get even one seat released and I was flexible on dates.

21 Apr 2012

Total posts 3006

“They’ve taken something that’s seen as being quite secondary and made it almost primary in decision-making terms"

I would say that is primarily due to status than to points on its own.

I do pity the fool, who flies once or twice a year, yet chooses to pay more to earn points/miles/avios.

10 Sep 2012

Total posts 149

Yup, points without status are pretty-much pointless. You see them all the time, the big dreamers who picture themselves using those points from Woolies and their credit-card to take the kids to Disneyland in biz. Not. Gonna. Happen.

Hi Guest, join in the discussion on Qantas' frequent flyer arm is now worth almost $4 billion